How to calculate and improve customer retention rate ?

Published on January 04, 2024 - Updated on August 16, 2024

How to calculate customer retention rate ?

"There is only one boss in the company: the customer! And he can fire anyone, from the CEO to the simple employee, just by spending his money elsewhere." - Sam Walton, founder of Wal-Mart.

Customer retention is crucial for businesses in all sectors. Loyal customers spend more money, return more often, and recommend the company to others. This is why businesses must not only measure their customer retention rate but also implement strategies to improve it. By understanding and enhancing customer retention, companies can increase profitability and foster long-term growth.

What is customer retention ?

Customer retention refers to the activities, tactics, and strategies that brands use to keep customers loyal and satisfied, preventing them from switching to the competition. For the company, this translates into retaining its customer base, who will pay attention to the brand's communication and the latest developments (products/services, etc.).

Investing in customer retention can optimize costs, as it far more cost-effective than aquiring new customers. In fact, it is five times more expensive to convert a new customer than to retain a loyal customer. By prioritizing retention, businesses can solidify their existing customer base while minimizing acquisition costs.

However, customer loyalty is built throughout the customer relationship journey, from the first contact to post-sales contact. This nurturing process is critical, as nearly 4 out of 5 consumers would prefer to pay more for a better customer experience.

Furthermore, customer retention helps reinforce brand awareness and creates brand advocates who will speak about your products and services to others.

Customer retention in numbers :

- 81% of consumers are willing to pay more for a better customer experience (Oracle – Loudhouse). This statistic highlights how improving the customer experience can directly impact your revenue.

- The probability of selling to an existing customer is 60 to 70%. The probability of selling to a prospect is 5 to 20% (Marketing Metrics). This underscores the value of focusing on existing customers for sustained growth.

- Acquiring a new customer costs 5 to 10 times more than retaining an existing customer (White House Office of Consumer Affairs).

- By reducing customer attrition by 5%, a company can improve its net profits between 25 and 85% depending on the cases (Bain & Company).

- On average, 15% of the most loyal customers contribute to 60% of an enterprise's total sales (Northwestern University).

- One very satisfied customer tells 3 people. Conversely, one dissatisfied customer lets 12 others know.

- 98% of unhappy customers never complain, however, 91% simply choose to leave.

Different types of customer loyalty :

Induced or forced loyalty :

Induced or forced loyalty is characterized by maintaining customer loyalty due to a lack of alternatives. This may result from binding contracts, market monopolies, or geographical barriers. For example, customers who continue using a telecommunications provider due to high cancellation fees, even if they are unsatisfied with the service.

Behavioral loyalty :

This occurs when loyalty is driven by convenience or routine, rather than a true preference for the brand. For example, a customer may frequent a coffee shop simply because it is on their usual route. However, this type of loyalty is fragile, and customers can switch brands if they find a better opportunity, making it crucial to continually offer competitive incentives.

Seeked loyalty :

Seeked or attitudinal loyalty, also known as acquired loyalty, directly results from marketing actions aimed at strengthening ties with customers. In this case, the customer repeats their purchases due to a genuine preference for the product and brand, based on a positive attitude towards your company. This type of loyalty is influenced by customer relations, price, product quality, and your brand's reputation. To cultivate this enduring loyalty, businesses must focus on customer relations, product quality, and brand image.

How to measure customer loyalty

To fully appreciate the value of your loyal customers, it is essential to measure their level of loyalty. This step is crucial for establishing a robust and sustainable loyalty strategy, allowing you to set more precise goals and implement an effective loyalty program.

Calculating customer loyalty

Customer loyalty helps determine the percentage of customers who have maintained their commitment to your brand over a defined period.

The frequency of measuring this loyalty varies from one company to another. Some prefer to assess loyalty rates quarterly or semi-annually, while others view it as an annual assessment of the effectiveness of their strategy.

Here’s a simplified formula to calculate your customer loyalty rate:

1. Take the number of customers your company had at the beginning of the period (B).

2. Subtract the new customers your brand acquired during this period (N).

3. Divide the resulting number by the total number of customers at the beginning of the period (E).

4. Multiply this fraction by 100 to get the final percentage.

Customer Loyalty Rate Formula : ((E-N)/B)*100

Let's understand this through an example :

A fashion brand intends to calculate its customer loyalty rate after launching a new clothing line. It uses an annual approach to calculating customer loyalty and gathers the following information about its customer numbers:

Customers at the beginning of the year (B) = 10,000

Customers at the end of the year (E) = 12,000

New customers acquired during the year (N) = 4,000

Using the formula above :

Customer Loyalty Rate = ((12,000 - 4,000) / 10,000) * 100 = 80%

The brand has a customer loyalty rate of 80%.

Here are some alternative tools to assess the degree of customer loyalty:

Net Promoter Score (NPS):

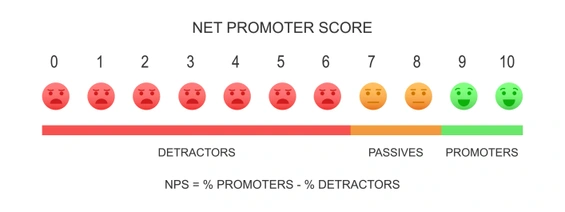

The NPS measures the likelihood of a customer recommending your brand to others. Customers provide a score from 1 to 10, categorizing them into three types:

Detractors : Score 1-6

Passives : Score 7-8

Promoters : Score 9-10

If you'd like to read our article on NPS, click here.

Customer churn rate

The customer churn rate is a crucial metric to understand why your once-loyal customers have stopped using your product or service. This metric encompasses account closures, subscription cancellations, non-renewal of service agreements or contracts, as well as decisions to switch service providers.

Tracking customer losses over a specific period is a key step to gain an overall view of your business dynamics. This is done by dividing the number of lost customers by the number of acquired customers during the same period.

Comparing with industry averages is a useful practice. For example, according to a Statista report, the churn rate in the financial services sector is approximately 25%, compared to 18% in the travel industry.

Repurchase ratio

The repurchase ratio evaluates the frequency of purchases by comparing regular customers to occasional ones, often adjusted based on the business model. For subscription-based purchases, record contract renewals and compare them to cancellations to obtain the ratio. If your business involves one-time sales, adjust the calculation by considering the number of customers buying at regular intervals, based on the time separating consecutive purchases by two regular customers.

Active engagement rate

This metric goes hand in hand with your repurchase ratio, providing a better understanding of the percentage of customers who regularly engage in your programs. Here, engagement is measured by the number of customers earning or spending points in a loyalty program within a specified period (monthly or annually).

The active engagement rate is an effective way to gain a clear insight into the performance of your program. By examining the number of customers engaging in your program – through earned and redeemed points, you can evolve your loyalty programs and enhance the customer experience.

Customer lifetime value

Customer Lifetime Value is a quantitative measure based on predicting the amount a particular customer belonging to a certain segment is expected to spend on your brand's offerings. This figure provides an estimate of the amount you can expect to generate from a customer segment. This is a useful way to decide on your key target customers, create targeted customer profiles, prioritize segments, and invest resources based on expected return on investment.

In conclusion, customer retention is more than just a business strategy; it is a fundamental pillar for building lasting and fruitful relationships with customers. Understanding the various nuances of loyalty, whether induced, forced, or sought, provides essential insights into the mechanisms that keep customers attached to a brand.

Tools such as the churn rate, repurchase ratio, and retention rates allow businesses to assess the health of these relationships and adjust tactics accordingly. In a constantly evolving business landscape, the ability to measure, analyze, and adapt to customer loyalty is crucial for companies seeking to thrive.

If you want to learn more, you can read our article on different tips for building customer retention: https://www.qemotion.com/en/blog/7-tips-to-retain-customers.

Similar posts

Customer Experience vs. Customer Success: Understanding the differences and maximising customer loyalty through emotional analysis

Published on October 29, 2024 - Updated on November 04, 2024

In an increasingly competitive business environment, companies must now redouble their efforts to capture and retain customers. According to a recent study by Forrester , 73% of companies now...

Reduce holiday stress with Q°emotion: How brands can manage customer emotions over Christmas

Published on October 29, 2024 - Updated on February 14, 2025

Reduce holiday stress with Q°emotion: How brands can manage customer emotions over Christmas Introduction: The Christmas paradox Although Christmas is traditionally a time of joy, sharing and celeb...