What is the churn rate? How to reduce it?

Published on November 12, 2021 - Updated on December 04, 2023

The best strategies to reduce your churn rate using semantic analysis.

Every business in the world loses customers. According to a study by Harvard Business Review, companies lose an average of 10% of their customers each year. With one-click competitive accessibility, the rise of new players, customer volatility has never been greater. However, acquiring new customers can cost between 5 and 25 times more than retaining existing ones; it is in the interest of calculating and analyzing your churn rate.

This article will detail how and why to analyze the churn rate and then we will see 3 strategies to reduce it.

1) What is the Churn rate?

Mainly used in the banking and insurance sector, the churn rate (or attrition rate) is an indicator that aims to calculate the total or partial loss of customers for a company. It is the inverse of the retention rate, which represents the ability of a company to retain its customers.

When we are in a customer-centric approach, attrition is, therefore, an indicator to follow closely.

It is possible to distinguish two types of attrition:

- Total attrition, loss of a customer. In this case, very often it leaves the mark to move towards the competition.

- Relative attrition, the customer is redirected to another offer or another product from the same company.

Therefore, it is very important to monitor this indicator very closely in order to be reactive and to draw relevant analyzes.

2) How to calculate the churn rate?

The Churn rate is very easy to calculate. In fact, all you have to do is divide the number of lost customers over a period by the total number of customers over the same period and multiply the result by 100.

For example, if a bank has 15,000 customers at the beginning of January and loses 600 during the month, then its attrition rate in January is: (600/15000) X 100 = 4%

How often should the churn rate be calculated?

Depending on the size of your company, the churn rate can be measured on a monthly or annual basis. It's important to bear in mind that measuring it just once is of little interest. It's by monitoring the evolution of the attrition rate following corrective actions that you'll get a true measure of their effectiveness.

What's more, in some business sectors, seasonality is a major factor. If you observe a rise in attrition rates during certain off-peak periods, this is undoubtedly the ideal time to launch specific campaigns (newsletters, promotions for the following season, product updates, etc.) in order to remain present in your customers' minds.

It's over the long term, and following the implementation of dedicated strategies, that measuring your attrition rate will prove most beneficial to your business.

3) Why is churn measurement so important?

You'd think that attracting more customers than those who leave wouldn't be a problem. Well, not quite. Here are 4 figures that illustrate the importance of attrition to your business:

- According to a study by Accenture, over $1,600 billion is lost by companies every year due to attrition. This alarming statistic clearly demonstrates the importance of optimizing the customer experience.

- As mentioned in the introduction, Forrester has shown in a study that acquiring a new customer costs companies 5 times more than keeping an existing one.

- If the above 2 figures still don't convince you, you should know that this Harvard Business School report shows that a 5% increase in the retention rate leads on average to an increase in profit of between +25 and +95%!

- Gartner has also demonstrated the importance of attrition rates. According to Gartner, 80% of a company's future profits will be generated by just 20% of its existing customer base.

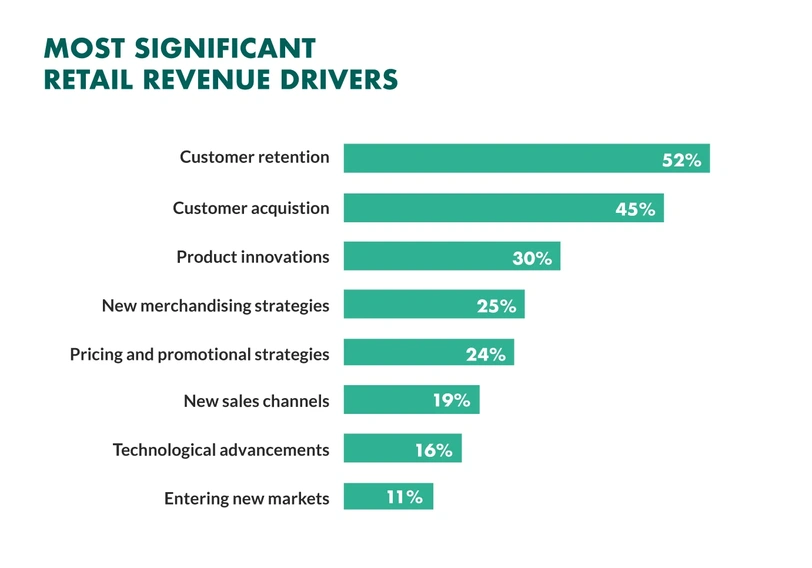

To finish convincing you, here's a table produced by KPMG which also shows that customer retention rate is the main factor driving revenue growth for companies.

4) How to correctly interpret the attrition rate?

Once the attrition rate has been calculated, the main difficulty encountered is interpretation. Indeed, is a rate of 4% a good, an average, or a bad rate?

Well, it all depends on the industry. For example, the banking sector traditionally has a low attrition rate which will be close to 5% while for telephone operators it will be more around 30%.

You will understand, a high attrition rate in one industry can be low in another, it's all about context.

Now that you know more about your churn, it is time to investigate the reasons for these departures and take corrective action.

Now that you have learned more about churn, it's time to investigate the reasons for these departures and how to establish corrective actions.

5) What are the reasons for attrition?

There are a multitude of potential reasons for high attrition rates:

- Your product or service is too complex to use. To solve this irritant, you can redirect your customers to tutorials, faqs, in order to help them to get used to your product.

- A poor customer experience. If the product or service you offer is of high quality, but the customer experience in your stores, on your website or with customer service is insufficient or not in line with your brand image, there's a good chance that this will increase your attrition rate. Nowadays, most products in the same category have similar technical characteristics, so it's often the customer experience that makes the difference and enables companies to build customer loyalty.

- Pricing. Some customers may decide to leave because they find the prices too high. In this case, you can either highlight the added value of the product/service to justify the high price, or simply make a price reduction, for example according to the customer's seniority.

- Changing consumer needs. Nowadays, technology is evolving faster and faster and with it, the needs of consumers. If we take the example of the computer industry or cell phones, new features appear every year such as facial recognition, new types of screens, more efficient batteries... and you have to follow these innovations to keep your customers.

- Competition. If your market is highly competitive, it is even more difficult to keep your customers. In this case, it's a good idea to offer a number of benefits to your longest-standing customers to reward them for their loyalty and encourage them to stay.

6) How to reduce churn rate?

Bad idea: retaining the customer by force

Sometimes the planets are simply not aligned and in this case you should not force your customers to stay.

Let's take an example.

Imagine you work for a digital company that offers a subscription service. If you decide at some point that you no longer want to display the "Unsubscribe" button in the Billing section because the product managers don't want to make it easy for a customer to cancel their contract. You may believe that by creating unfair barriers that make it harder for customers to cancel the contract, it will have a positive impact on the customer's lifetime.

Short-term impact

In the short term, this decision will prevent some customers from leaving the service and it may indeed prevent some lost sales.

The short-term impact on churn is therefore generally positive.

Long-term impact

But in the long run, the decision will cause frustration and anger.

Once the customer has made up his mind to leave you, stopping him from doing so is very often prohibitive and futile. Your company will have to serve unsatisfied customers and this will ultimately cost more, they will be more reluctant to pay for the service they received and eventually they will leave anyway.

However, since it was difficult to unsubscribe, in the future they will be more reluctant to return to your offer even if your competitors offer a worse service.

But the worst thing is the impact on your brand image. Indeed, if customers are angry, they may dissuade others from becoming customers and the company's image will be affected for a long time.

Last remark: when at a given moment the company acts in the interest of the customer quickly and efficiently, (for example when a company compensates immediately and without difficulty, etc.), a rise in customer confidence towards the company is immediately observable, which leads to a stronger loyalty and will therefore increase the company's net result in the long term, with a generally short-term return on investment.

In the rest of this article, we will detail 3 strategies to reduce the attrition rate.

7) 5 strategies to reduce churn rate

a) Collect and gather your customers' feedback

Who knows better than your customers when it comes to telling you about their experiences? Most of the time, you'll be able to identify the reasons for attrition directly from what your customers have to say.

To do this, you can start by scanning social networks or forums specialized in your industry. Generally speaking, this is where your customers discuss your products/services amongst themselves. Not only will this enable you to spot whether any of your customers are regularly criticizing your brand, which supposes they are at a high risk of attrition. But it will also enable you to identify the topics that are being discussed and so to detect potential irritants. Of course, all this also applies to online review sites such as TrustPilot or Google Reviews.

However, to reduce your attrition rate even more effectively, you need to be proactive and solicit your customers yourself.

That's why it's highly advisable to set up satisfaction surveys, which will enable you to collect both quantitative opinions and qualitative customer feedback.

This has several advantages. Firstly, it gives you a concrete view of your customer journeys, and more generally of the customer experience offered by your company. Secondly, it makes it much easier to segment your customers according to their degree of satisfaction (promoters/detractors/neutrals in Net Promoter Score surveys). Finally, it allows you to create a closer bond with your customers, who will feel listened to and valued by your company.

What's more, based on your customers' qualitative comments or verbatims, semantic analysis makes it possible to implement different strategies to lower your churn rate. At Q°emotion, following the analysis of several million verbatims, we have identified 3 proven methodologies based on customers' feedback to effectively reduce attrition. We're going to illustrate these using the banking sector as an example.

b) Identify the initial explicit threats and analyze the direct causes

A first method aims to directly target and listen to the customers who threaten you to leave and to locate explanatory elements on these comments. This process is quick because it is quite selective: you only go through attentive listening to customers who tell you that they are going to leave you.

This is why the first step is to look in the client's words for an explicit threat to leave. A semantic analysis tool can offer you this type of categorization in direct and immediate reading: this allows you to very quickly identify the most critical verbatim and react to retrieve a certain number of customers.

Customer Alerts screens on the CXinsights.io platform

A complementary approach consists in comparing the subjects mentioned in these comments which explain a desire to start with the verbatim of all of your customers.

This method allows the most critical irritants to be detected very precisely.

When comparing the themes mentioned, there can be 2 different scenarios:

o The subjects are totally different. If the explicit comments address themes that are fairly well experienced overall by all of your customers, then these may be isolated cases or the emergence of an irritant that will therefore need to be monitored in the short term.

o On the other hand, if the themes that emerge in the verbatim that threaten to leave you are also generally badly experienced, then this is a critical irritant that must be resolved as a priority to stop the bleeding.

This method, therefore, allows you to detect weaker signals earlier and in a more targeted manner. The causal link between the problem and the customer's departure is proven and therefore you can mobilize forces to reduce the causes of attrition.

Be careful, however, this approach has two limits:

o If you do not have enough data. It requires a minimum volume of data (at least 10,000 comments) to obtain a minimum volume of initial threats.

o It is not exhaustive. While all of the points identified have an impact on attrition, all the trigger points for attrition are not necessarily identified.

To overcome these limitations, the implementation of a less targeted approach is possible, for example in a second phase or in the event of a methodological blockage.

c) Optimize your customer communication channels

When it comes to customer-company relations, communication is key! Optimizing customer communication channels is crucial to reducing customer attrition. By cultivating strong, personalized relationships with your customers, you strengthen their loyalty to your company. Consider diversifying your communication channels to adapt to your users' preferences. Social networks, e-mail and chatbots, for example, enable you to offer a more responsive customer service tailored to individual needs, helping to improve the customer experience. By the same token, don't wait for your customers to contact you, and adopt a proactive communication approach. Resolving problems quickly and providing relevant information boosts customer satisfaction, reducing the risk of losing them to the competition. By investing in optimizing your communication channels, you can therefore not only preserve your existing customer base, but also foster their long-term commitment, resulting in a significant reduction in attrition rates.

d) Identify, prioritize and resolve irritants globally

The complementary method is indeed less targeted: it conventionally consists in emotionally analyzing customer comments, in detecting and dealing with the irritating points of the experience.

By improving the experience for all customers, and by solving the main irritants, you are making the - quite logical - bet that some customers will stay longer because they will be more satisfied.

The emotional connection seen above is restored, your customers stay and recommend you.

Irritants are emotional in nature. Detecting the emotion also helps you to understand the limits of acceptability (which generates anger) and the urgent needs for change (expressed by disgust (which is therefore often accompanied by a high risk of attrition), to understand reassurance needs (expressed as fear) and disappointed customer expectations (expressed as sadness).

Finally, you will start from the premise that your survey and feedback methodology is correct: by responding to the problems expressed by your customers who speak up, you should reach the thousands of customers who have not spoken ... and generate a beneficial multiplier effect.

Analyzing the most critical comments is often the preferred approach because it is the easiest to achieve and the return on investment on satisfaction is obvious.

This process takes longer than the previous one because it is less selective: you go through attentive listening to all customers and not just those who threaten to leave you. In the absence of focus, you run the risk of dispersing yourself on elements that are a little less priority from a business point of view. In fact, not all irritants necessarily cause the client to leave. Even though a specific point of the experience is often disappointing, it does not necessarily justify leaving you on its own.

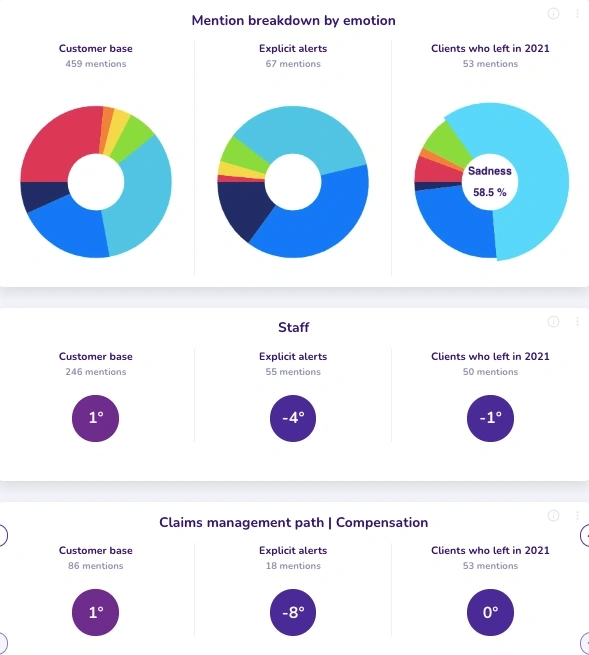

So, to go faster, or if your resources are very limited, or you want to focus your actions on what will more directly impact the loyalty of your customers, it may be preferable to focus on the most emotionally critical irritants. On a solution such as CXinsights.io by Q°emotion, you can measure the volume of mentions and the emotional index of each irritant and choose these indicators to prioritize the actions.

In short, solving the most emotionally critical irritants allows you to move quickly and have a higher chance of reaching all of the causes of attrition expressed or not expressed explicitly by your customers.

e) Analyze a posteriori the opinions of customers who have already left and build alerts

The last approach has a predictive vocation. The idea is to identify risks upstream start and take action to minimize your attrition. But how to do it?

Unlike the two previous methods, this time the goal is to analyze the topics raised and the emotions expressed by your customers who have already left.

Unfortunately, not all of them will tell you that they are leaving. On the other hand, you can list your customers who left this year, for example, and analyze the comments they left with you last year.

By looking at the themes mentioned by these former clients, as well as their emotions, you will be able to prioritize the corrective actions to be taken with all of the operational.

For example, in the example above, we can see that out of the 53 customers who left in 2021, all of them have mentioned compensation at some point. This, therefore, means that this subject is particularly sensitive and that it should be treated as a priority.

Once identified, complete profiles can be segmented based on the criteria following:

- emotions and/or

- thematic subjects and/or

- key segmentation criteria (agencies/clients/etc)

- satisfaction or recommendation scores

- keywords

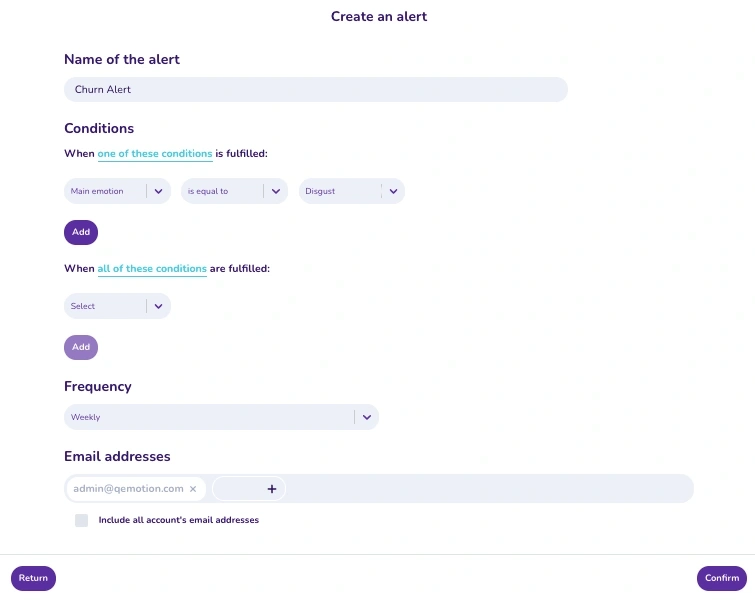

By building attrition personas in this way, we can easily create warning scenarios.

The implementation of automatic alerts in a semantic analysis platform such as CXinsights.io, is then possible: it allows you to send to one or several email addresses the list of alerts:

- by adapting the volume of alerts via the choice of more or less restrictive conditions

- by allocating the message to the right operational level

- by anticipating or saving him time

- by modulating the level of response to be provided to customers

You then go from a reactive to a proactive approach. These predictive alerts will therefore allow you to launch personalized preventive actions to survey customers who are likely to leave your business.

Measuring churn, therefore, provides a better view of customer satisfaction. By coupling this to the measurement of other key indicators such as the NPS (5 strategies to improve your NPS), you will be able to determine more precisely what your customers' needs are and boost your loyalty!

Similar posts

Customer Experience vs. Customer Success: Understanding the differences and maximising customer loyalty through emotional analysis

Published on October 29, 2024 - Updated on November 04, 2024

In an increasingly competitive business environment, companies must now redouble their efforts to capture and retain customers. According to a recent study by Forrester , 73% of companies now...

Reduce holiday stress with Q°emotion: How brands can manage customer emotions over Christmas

Published on October 29, 2024 - Updated on February 14, 2025

Reduce holiday stress with Q°emotion: How brands can manage customer emotions over Christmas Introduction: The Christmas paradox Although Christmas is traditionally a time of joy, sharing and celeb...